On my last post I spoke about the use of Blockchain for Accurate Carbon Footprint Tracking, with an explanatory approach, which I highly recommend you have a read before moving on to this one.

This time around, I looked into analysing a bit deeper the concept and look at how these companies are actually implementing the carbon offsetting they claim to do.

* * *

Carbon credits and tokenisation has recently gained a lot of traction in the fight against global warming, provide better conditions for farmers and reinvest in lands that feed the world.

But I see this as a way for (some) big corporations to escape the actual problem they contribute to — very high CO2 emissions into Earth’s ozone layer, often resulting in empty marketing lullabies.

But, you may wonder, what do you mean by empty marketing lullabies and why is it an issue?

You guessed it. In simple terms I’m talking about greenwashing which is nothing more than a deceptive marketing practice where companies falsely portray themselves as environmentally friendly. Often this misleads consumers and investors who may be supporting unsustainable practices without knowing, hindering the transition to a greener economy.

It also undermines genuinely eco-conscious businesses, making it hard to identify real sustainability leaders. Vigilance and holding companies accountable are vital to foster genuine sustainability efforts and drive positive environmental change.

What about carbon offsetting and tokenisation?

If you haven’t read my previous article, here’s a short explanation.

Carbon offsetting/credits and tokenisation are two distinct but related concepts in environmental sustainability. Carbon offsetting involves compensating for one’s carbon emissions by investing in projects that reduce or capture an equivalent amount of greenhouse gases from the atmosphere. These projects can include renewable energy initiatives, reforestation efforts, protection of human rights and many, many others.

On the other hand, carbon tokenisation uses blockchain technology to create digital tokens representing carbon credits. These tokens can be traded and used as a transparent and traceable way to track and verify carbon offset transactions. By combining these concepts, the carbon tokenisation industry aims to create a more accessible, efficient, and accountable system for supporting carbon reduction and promoting sustainable practices.

Going back to…

… the CO2 emissions made by corporations, this often is made throughout the supply chain that products we consume and use go through, but we, consumers, are unaware or rarely think about.

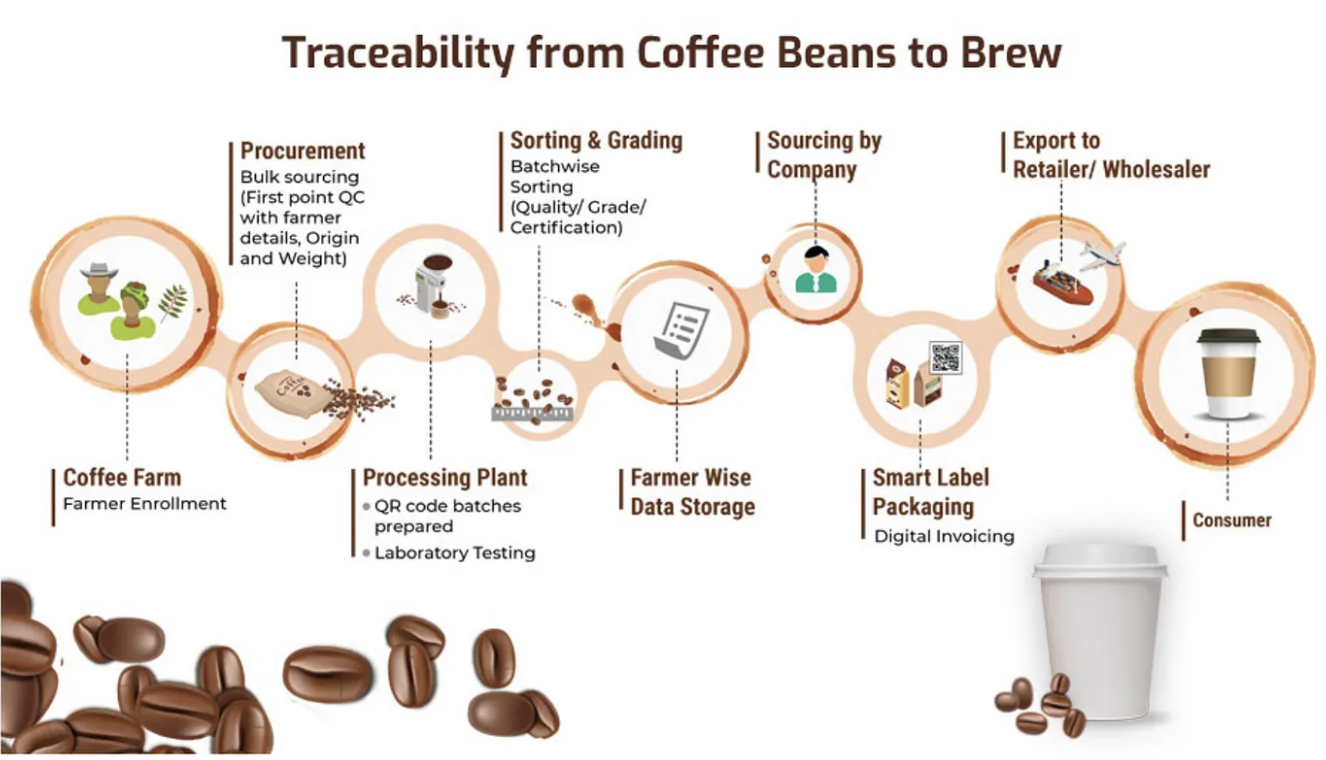

For example, if you live in the UK and you go to your usual coffee shop to have your daily salvation drink, have you ever questioned yourself where the coffee beans came from? Or where have they been up to the point they are ground upon order?

https://www.sourcetrace.com/blog/traceable-blockchain-solutions-for-your-cuppa-coffee/

The whole supply chain from plantation and harvest up until you order, involves several workers in several countries, numerous contracts and invoices, warehouses for storage, methods of transportation, wholesale deals, packaging, worldwide negotiations, they’re prone to market fluctuation, and surely several other processes I’m not aware of.

All of these processes involve physical human effort that often is not compensated as it should and the pollution caused by the packaging, transportation and delivery to the end consumer contribute largely to the carbon footprint of a product.

In the vast majority of cases, those lower in the chain (farmers/producers) are the ones who get the least compensation for the goods they produce, and as if it wasn’t enough, they are also the ones who get affected the most by natural disasters.

Analysing Companies in the Carbon Tokenisation Sphere

I decided to pick 3 different companies, from 3 different countries who all provide carbon credits. These are:

1. Carbon Future, Germany, founded in 2020.

Our goal was simple — to speed up the transition to a net-zero future by scaling carbon removal to the gigatonne level, securing a just and livable future for generations to come.

2. Rubicon Carbon, USA, founded in 2022

We are building an ecosystem of customers, investors, project developers, and technology partners that will bring new capabilities and leadership to the carbon markets.

3. MyPlan8, India, founded in 2022.

To be an impact brand with the best climate impact solution to improve the planet. We solve the individual problem of how to help with climate change by providing avenues to reduce and offset and by assisting them in tracking their carbon footprint.

https://www.newstatesman.com/wp-content/uploads/sites/2/2023/06/09/NS-Spotlight-Climate-Change-Supplement-June-2023.pdf

Disclaimer: Solely analysing 3 companies, their methodologies, goals and projects and from there draw conclusions, can lead to erroneous outcomes. At no point did I get in touch with the companies listed above and asked for more details on their endeavours, so keep in mind this is my personal view and understanding. At any point feel free to leave your feedback.

At first sight, it’s clear that most of these projects are very recent, mostly founded in the last 3 to 5 years. This is not only because the technologies used have only recently gained more maturity but also, given the scale, complex ecosystems and the processes required to develop, review and approve can take several months. It also helps that the 2030 SDG goals will not be met and suddenly everyone cares about the environment (a.k.a. a lot of investment is being made in companies who provide sustainable solutions to reach those goals).

It’s also clear that many of the projects are not as transparent as they could be. Even though I mention those three companies, I got to know a few others while writing this article, and from the 20–25 companies I laid eyes on, only 3 provided relevant information about the initiatives they worked with.

If you’ve heard of blockchain, you’ve heard of transparency and traceability. I assumed that most of these companies working with carbon credits would provide to the public an actual transparent way of tracking those credits and showing the progress on the initiatives they’re involved with.

Quite the contrary, very often you find nothing more than static, informative pages about the location, communities, lands and productions of those projects (if that).

Carbon Future, for example, serves almost as a broker between suppliers and buyers of these tokens. Companies like Carbon Future usually profit from a fee charged per transaction between those two parties.

It’s a fair idea. Communities who need investment in order to develop and expand their lands and businesses, or charities who actively look to improve fauna, flora and human rights, receive money from bigger corporations who don’t necessarily have a way of immediately reducing their carbon footprint, but are keen to compensate their emissions somehow.

Rubicon Carbon, on the other hand, although it offers similar services as Carbon Future, they also have a big portfolio of partnerships with companies who specialise in activities like observing, collecting and measuring data of the world around us and with that information, develop plans to tackle the most urgent issues.

Apart from informing what carbon credits can buy and do, neither Rubicon Carbon nor Carbon Future have information on projects they are actively working on, what areas are they most invested in, what type of investors and investments are contributing to, nor what outcomes or benefits have resulted in their efforts.

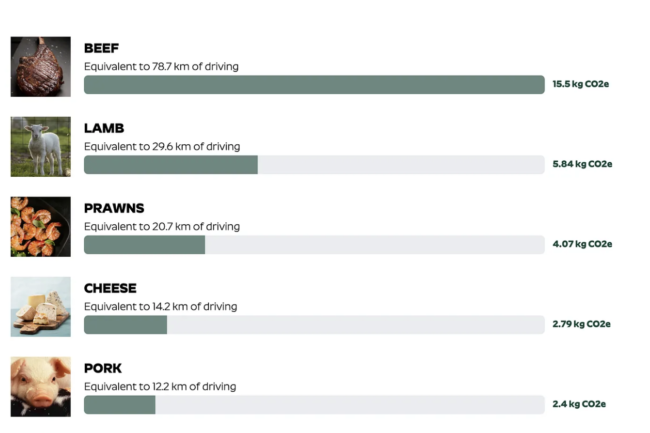

MyPlan8 was one of the companies I found to be more informative and interactive. Besides explaining in clear terms what is carbon footprint and several articles on how you can reduce yours, they also provide a way to calculate your personal carbon footprint and to purchase credits to offset them.

In their application you can find daily actions you can take and to what SDG’s goals you are contributing to by doing them. They also provide clear information on the carbon emissions from different industry sectors with the equivalence of km driven which makes it easier to understand and compare.

The lack of transparency by a lot of companies, like Carbon Future and Rubicon Carbon, on what and with whom carbon credit deals are made leaves room for questions on their genuine concern for a better environment to arise.

Organisations like Greenpeace and Source Material dedicate their efforts to unmasking practices and the real interest behind the investments made by companies when it comes to carbon credits.

Companies like Shell, which is nothing more than the second largest oil and gas company in the world by revenue ($92.728B, a 3.96% increase YoY), are happily investing in carbon offsetting projects and in their marketing efforts.

I’d invite you to read the following articles if you’d like to know more about the work Greenpeace and SourceMaterial are doing and draw your own conclusions.

- https://www.newstatesman.com/wp-content/uploads/sites/2/2023/06/09/NS-Spotlight-Climate-Change-Supplement-June-2023.pdf

- https://www.source-material.org/vercompanies-carbon-offsetting-claims-inflated-methodologies-flawed/

- https://www.newstatesman.com/spotlight/sustainability/energy/2023/06/carbon-emissions-offsetting-system-credits-climate-change

- https://www.greenpeace.org.uk/news/the-biggest-problem-with-carbon-offsetting-is-that-it-doesnt-really-work/

* * *

When the biggest contributors to carbon emissions decide to buy carbon credits to offset in the order of millions of dollars and use that in several public campaigns, they will likely be accused of greenwashing for obvious reasons. But are they the only ones to blame?

Even though a lot of companies have genuinely good intentions, at the time of calculating profit & loss, it’s clear that between money and environment, money still wins.

Companies like Carbon Future and Rubicon Carbon, who serve as middleman between buyers and suppliers of carbon credits, are the ones who really need to make a difference and stay loyal to a greener future by having a stricter criteria for buyers.

Yet when quarterly articles come out that anticipates the carbon credits market to be worth $50bn by 2030, it’s expected that more money will keep being poured into new startups that provide those credits. Often investments made without due diligence nor genuine interest for improving environmental matters.

When it sounds too good to be true, it usually is.